江蘇融資擔保行(xing)業再次洗牌

2017-05-27

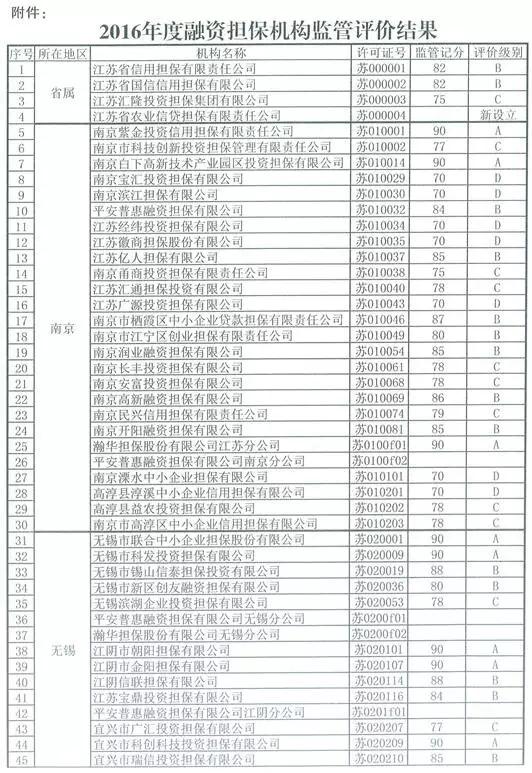

近日,江蘇(su)省經(jing)信委對融資擔保(bao)機構2016年(nian)合(he)規(gui)經(jing)營情況進行了全面檢(jian)查,并(bing)公布了持(chi)證(zheng)機構的(de)監(jian)管評價結果(名單附(fu)后),融資擔保(bao)行業一(yi)年(nian)一(yi)度的(de)洗牌工作再次告一(yi)段落。 我(wo)國(guo)的(de)(de)融(rong)(rong)資擔保(bao)(bao)行(xing)業(ye)(ye)源自1993年11月(yue)國(guo)務院批準(zhun)設(she)立(li)的(de)(de)第一家全(quan)國(guo)性專業(ye)(ye)信用擔保(bao)(bao)公司——中(zhong)(zhong)國(guo)經濟(ji)技(ji)術投(tou)資擔保(bao)(bao)公司,此后,從上世紀90年代末起,擔保(bao)(bao)行(xing)業(ye)(ye)進入快速發(fa)展軌(gui)道。直至2010年3月(yue),中(zhong)(zhong)國(guo)銀監(jian)(jian)會等(deng)7部(bu)委以2010年第3號令(ling)頒(ban)布《融(rong)(rong)資性擔保(bao)(bao)公司管理暫行(xing)辦法》,融(rong)(rong)資擔保(bao)(bao)行(xing)業(ye)(ye)進入清理整頓(dun)、規(gui)范(fan)發(fa)展的(de)(de)時代,各(ge)地(di)監(jian)(jian)管部(bu)門實(shi)施了全(quan)行(xing)業(ye)(ye)規(gui)范(fan)整頓(dun)工作。截至2011年6月(yue)末,全(quan)國(guo)規(gui)范(fan)整頓(dun)合格的(de)(de)機(ji)構共6473家,頒(ban)發(fa)融(rong)(rong)資性擔保(bao)(bao)機(ji)構經營許(xu)可證5888張,其中(zhong)(zhong),江蘇(su)省(sheng)具備資質的(de)(de)融(rong)(rong)資擔保(bao)(bao)公司數量高達(da)863家。

我(wo)國(guo)的(de)(de)融(rong)(rong)資擔保(bao)(bao)行(xing)業(ye)(ye)源自1993年11月(yue)國(guo)務院批準(zhun)設(she)立(li)的(de)(de)第一家全(quan)國(guo)性專業(ye)(ye)信用擔保(bao)(bao)公司——中(zhong)(zhong)國(guo)經濟(ji)技(ji)術投(tou)資擔保(bao)(bao)公司,此后,從上世紀90年代末起,擔保(bao)(bao)行(xing)業(ye)(ye)進入快速發(fa)展軌(gui)道。直至2010年3月(yue),中(zhong)(zhong)國(guo)銀監(jian)(jian)會等(deng)7部(bu)委以2010年第3號令(ling)頒(ban)布《融(rong)(rong)資性擔保(bao)(bao)公司管理暫行(xing)辦法》,融(rong)(rong)資擔保(bao)(bao)行(xing)業(ye)(ye)進入清理整頓(dun)、規(gui)范(fan)發(fa)展的(de)(de)時代,各(ge)地(di)監(jian)(jian)管部(bu)門實(shi)施了全(quan)行(xing)業(ye)(ye)規(gui)范(fan)整頓(dun)工作。截至2011年6月(yue)末,全(quan)國(guo)規(gui)范(fan)整頓(dun)合格的(de)(de)機(ji)構共6473家,頒(ban)發(fa)融(rong)(rong)資性擔保(bao)(bao)機(ji)構經營許(xu)可證5888張,其中(zhong)(zhong),江蘇(su)省(sheng)具備資質的(de)(de)融(rong)(rong)資擔保(bao)(bao)公司數量高達(da)863家。

2013年,江蘇國資控股的(de)(de)(de)(de)(de)中(zhong)融(rong)信佳擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)曝出(chu)巨額違(wei)規擔(dan)(dan)(dan)(dan)保案后,江蘇省(sheng)開始(shi)著手整(zheng)頓(dun)擔(dan)(dan)(dan)(dan)保業混亂(luan)局面。從2014年開始(shi),擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)代(dai)償規模(mo)(mo)急(ji)劇(ju)(ju)上升,很多企業經營不下去。截(jie)(jie)至2014年6月底,全(quan)省(sheng)融(rong)資性擔(dan)(dan)(dan)(dan)保機(ji)(ji)構(gou)僅剩(sheng)下413家(jia)(含34家(jia)分(fen)(fen)支機(ji)(ji)構(gou)),截(jie)(jie)至2015年6月底,全(quan)省(sheng)融(rong)資擔(dan)(dan)(dan)(dan)保機(ji)(ji)構(gou)僅剩(sheng)317家(jia),較2011年高峰(feng)時劇(ju)(ju)減63%。不過(guo)與(yu)以前的(de)(de)(de)(de)(de)被動整(zheng)頓(dun)不同,這一輪摘牌的(de)(de)(de)(de)(de)公(gong)(gong)(gong)司(si)中(zhong),大部分(fen)(fen)屬于(yu)擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)主(zhu)動退出(chu)。擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)在(zai)融(rong)資鏈條中(zhong)一直都處于(yu)較為(wei)(wei)尷尬的(de)(de)(de)(de)(de)地位,一方面是(shi)(shi)擔(dan)(dan)(dan)(dan)保費率只有(you)2%-3%;另一方面,所承受風(feng)險卻是(shi)(shi)100%的(de)(de)(de)(de)(de)。尤(you)其(qi)是(shi)(shi)民營擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)規模(mo)(mo)小(xiao)、實力弱,跟(gen)銀(yin)行的(de)(de)(de)(de)(de)合(he)(he)作(zuo)處于(yu)非常(chang)弱勢的(de)(de)(de)(de)(de)地位,一些(xie)公(gong)(gong)(gong)司(si)為(wei)(wei)了盈利和(he)提高股東分(fen)(fen)紅,不得不直接放貸(dai),引發銀(yin)行對(dui)擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)的(de)(de)(de)(de)(de)信任危機(ji)(ji),普遍不愿意跟(gen)民營擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)合(he)(he)作(zuo),導致(zhi)一些(xie)經營規范的(de)(de)(de)(de)(de)民營擔(dan)(dan)(dan)(dan)保公(gong)(gong)(gong)司(si)也只能主(zhu)動退出(chu)市場。

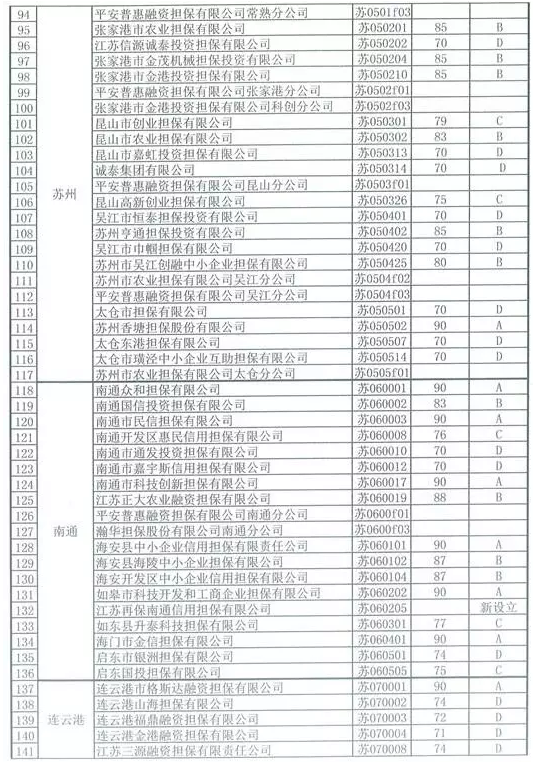

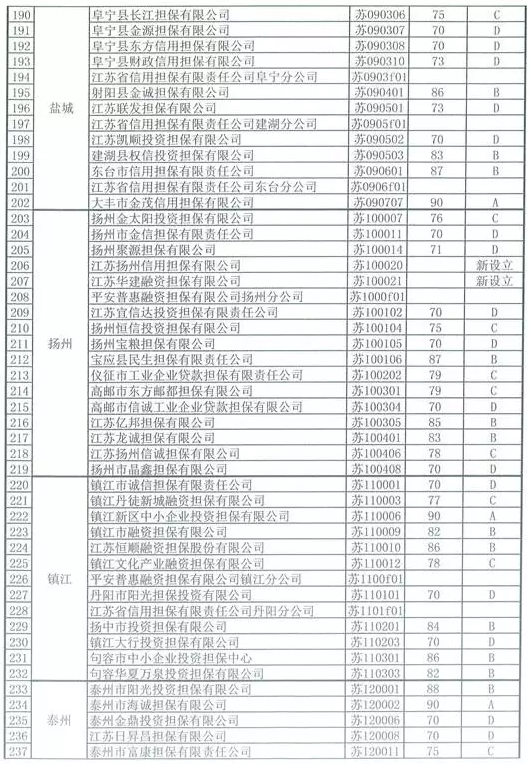

近日出爐的(de)評(ping)價結(jie)果顯示,共有275家融資擔保(bao)機(ji)構通過2016年的(de)年審,確定監(jian)管級別,并(bing)鼓勵(li)優(you)質擔保(bao)機(ji)構積(ji)極創新、做大做強,引(yin)領和帶動行(xing)業整(zheng)體發展。對(dui)D級機(ji)構,將突出資本(ben)金使用和業務經營兩(liang)個重(zhong)點,加大現(xian)場檢查力度,督促抓好(hao)整(zheng)改,嚴密防范風險。

275家(jia)機構(gou)中(zhong)有6家(jia)是(shi)新(xin)(xin)設立(li)(li),分別是(shi)江蘇(su)(su)省(sheng)(sheng)(sheng)農(nong)(nong)(nong)業(ye)信(xin)(xin)(xin)(xin)貸(dai)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)、江蘇(su)(su)再(zai)保(bao)(bao)(bao)(bao)(bao)(bao)南通信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)、江蘇(su)(su)省(sheng)(sheng)(sheng)信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)有限責(ze)任(ren)公司(si)淮(huai)安(an)分公司(si)、江蘇(su)(su)揚州(zhou)(zhou)信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)、江蘇(su)(su)華建融資(zi)(zi)(zi)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)、泰州(zhou)(zhou)興農(nong)(nong)(nong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)投資(zi)(zi)(zi)。其(qi)(qi)中(zhong),江蘇(su)(su)省(sheng)(sheng)(sheng)農(nong)(nong)(nong)業(ye)信(xin)(xin)(xin)(xin)貸(dai)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)是(shi)新(xin)(xin)設立(li)(li)的第四家(jia)江蘇(su)(su)省(sheng)(sheng)(sheng)屬(shu)融資(zi)(zi)(zi)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)機構(gou),2016年(nian)(nian)9月30日(ri)獲批成(cheng)立(li)(li),首期注冊資(zi)(zi)(zi)金10億元(yuan),主要是(shi)為(wei)農(nong)(nong)(nong)業(ye)尤其(qi)(qi)是(shi)糧食適度(du)規(gui)模經營主體貸(dai)款提供信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao);江蘇(su)(su)省(sheng)(sheng)(sheng)農(nong)(nong)(nong)業(ye)信(xin)(xin)(xin)(xin)貸(dai)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)、江蘇(su)(su)再(zai)保(bao)(bao)(bao)(bao)(bao)(bao)南通信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)、江蘇(su)(su)省(sheng)(sheng)(sheng)信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)有限責(ze)任(ren)公司(si)淮(huai)安(an)分公司(si)、江蘇(su)(su)揚州(zhou)(zhou)信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)連同(tong)以(yi)前年(nian)(nian)度(du)設立(li)(li)的江蘇(su)(su)省(sheng)(sheng)(sheng)信(xin)(xin)(xin)(xin)用(yong)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)公司(si)及其(qi)(qi)分公司(si)、常(chang)州(zhou)(zhou)高新(xin)(xin)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)公司(si)等都是(shi)江蘇(su)(su)再(zai)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)集團全資(zi)(zi)(zi)或參(can)股的融資(zi)(zi)(zi)性擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)機構(gou),集團化發(fa)展的優勢凸顯。年(nian)(nian)審結果顯示,有74家(jia)評級為(wei)D類(lei),約(yue)占(zhan)(zhan)總數的26.81%;有24家(jia)評級為(wei)A類(lei),約(yue)占(zhan)(zhan)總數的8.70%,其(qi)(qi)中(zhong)全省(sheng)(sheng)(sheng)4家(jia)省(sheng)(sheng)(sheng)屬(shu)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)機構(gou),除剛設立(li)(li)的省(sheng)(sheng)(sheng)農(nong)(nong)(nong)業(ye)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)沒有評級外(wai),其(qi)(qi)余(yu)三家(jia)均沒有獲得A類(lei);而13個地(di)級市中(zhong),徐州(zhou)(zhou)、淮(huai)安(an)、揚州(zhou)(zhou)三個地(di)區沒有一(yi)家(jia)擔(dan)(dan)(dan)保(bao)(bao)(bao)(bao)(bao)(bao)機構(gou)獲得A類(lei)評級。

經過清理(li)整頓,融(rong)(rong)(rong)資(zi)擔(dan)保(bao)行業為中小微實體企業成長發(fa)展(zhan)發(fa)揮巨(ju)大作(zuo)用,各級政府十分重視。2015年(nian)3月(yue)(yue),江蘇(su)省(sheng)(sheng)政府印發(fa)《關于促進全(quan)省(sheng)(sheng)融(rong)(rong)(rong)資(zi)擔(dan)保(bao)行業健康發(fa)展(zhan)的(de)(de)意(yi)(yi)見》;8月(yue)(yue),國務院印發(fa)《關于促進融(rong)(rong)(rong)資(zi)擔(dan)保(bao)行業加(jia)快(kuai)發(fa)展(zhan)的(de)(de)意(yi)(yi)見》;國務院法(fa)制辦(ban)又發(fa)布了(le)《融(rong)(rong)(rong)資(zi)擔(dan)保(bao)公(gong)司(si)(si)管理(li)條(tiao)例(li)(征求意(yi)(yi)見稿)》;2017年(nian)5月(yue)(yue),銀(yin)監會公(gong)布的(de)(de)立法(fa)計劃明(ming)確在2017年(nian)完(wan)成《融(rong)(rong)(rong)資(zi)擔(dan)保(bao)公(gong)司(si)(si)管理(li)條(tiao)例(li)》的(de)(de)制定(ding)工作(zuo),融(rong)(rong)(rong)資(zi)擔(dan)保(bao)行業必(bi)將進入新的(de)(de)發(fa)展(zhan)階段。 (來(lai)源:再保(bao)金(jin)融)